VA DoT ST-9 & ST-9A 2023-2026 free printable template

Show details

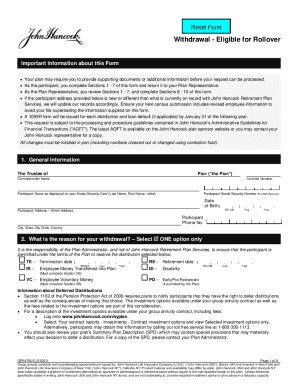

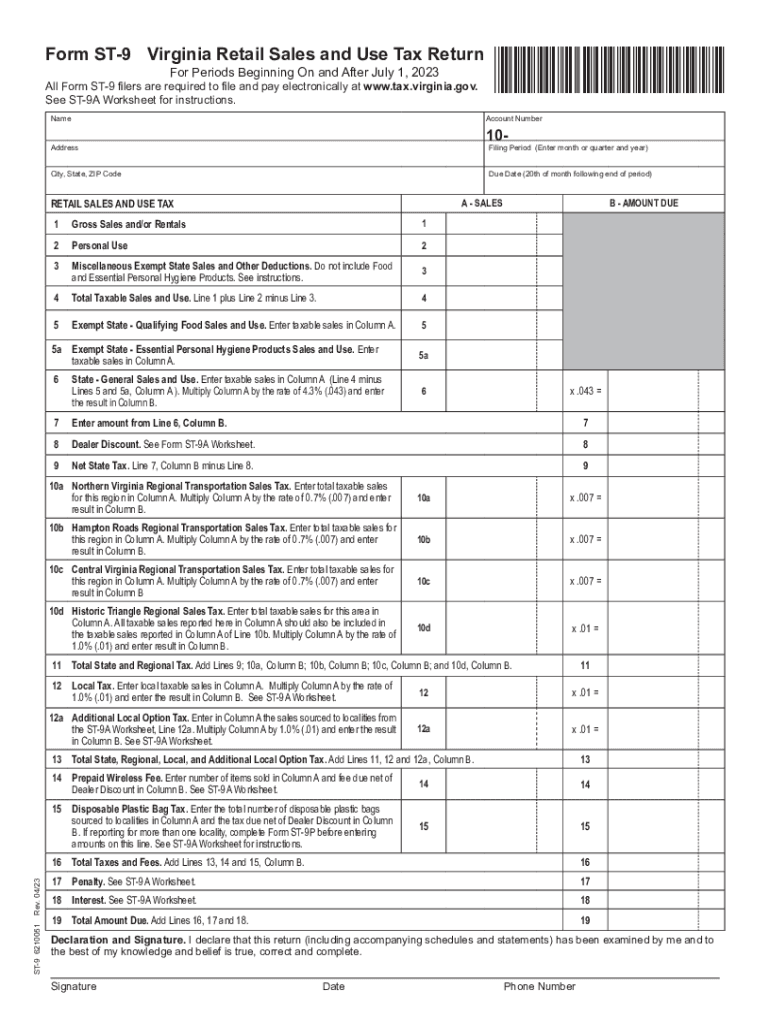

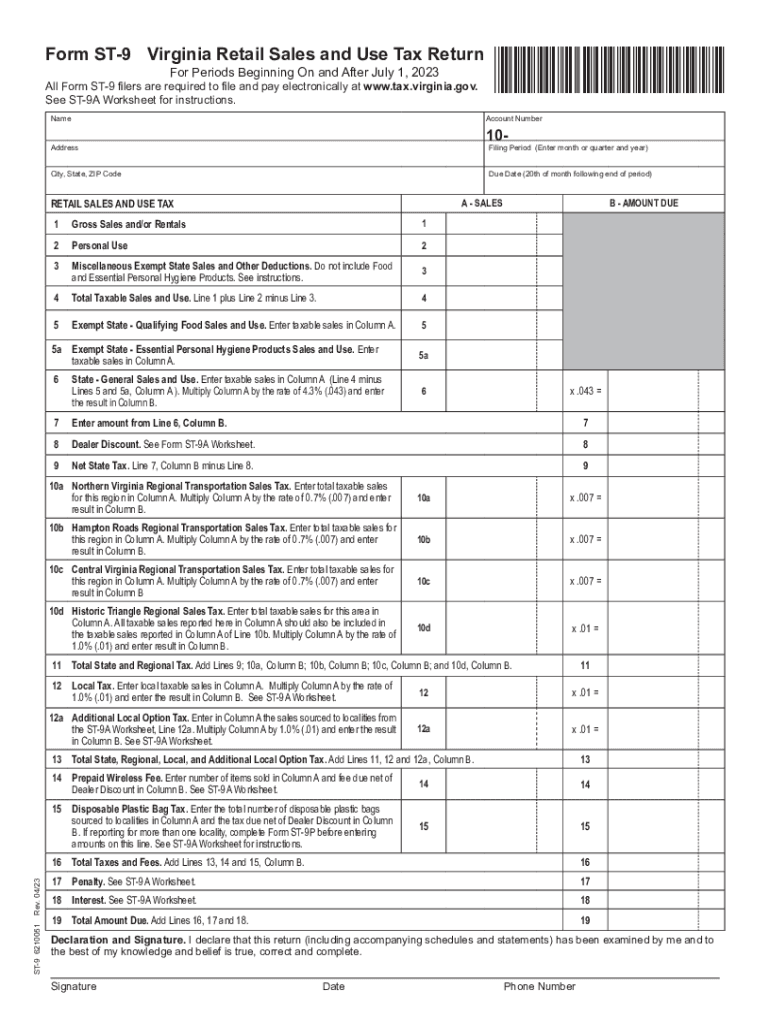

Form ST9Virginia Retail Sales and Use Tax Returner Periods Beginning On and After July 1, 2023All Form ST9 filers are required to file and pay electronically at www.tax.virginia.gov. See ST9A Worksheet

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign st 9 form

Edit your st9 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales tax va form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing st9 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form st 9 virginia. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT ST-9 & ST-9A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out va st 9 form

How to fill out VA DoT ST-9 & ST-9A

01

Obtain VA DoT ST-9 and ST-9A forms from the Virginia Department of Transportation website or local office.

02

Read the instructions provided for each form carefully to understand the required information.

03

For VA DoT ST-9, fill in your personal information including name, address, and contact details.

04

Provide information about the vehicle including make, model, year, and VIN (Vehicle Identification Number).

05

Indicate the reason for the application on the form.

06

For VA DoT ST-9A, enter the details regarding any changes or updates needed related to the vehicle or ownership.

07

Review all information for accuracy before submission.

08

Submit both forms to the appropriate Virginia Department of Transportation office either in person or by mail.

Who needs VA DoT ST-9 & ST-9A?

01

Individuals seeking to register a vehicle in Virginia.

02

Those who need to report changes related to vehicle ownership or details.

03

Owners looking to apply for certain driving privileges or vehicle title changes.

Fill

st 9 va tax form

: Try Risk Free

People Also Ask about virginia form st 9 sales and tax

What is form VA 5?

Form VA-5 Employer's Quarterly Return of Virginia Income Tax Withheld.

What is the sales tax in VA Dept of Taxation?

The sales tax rate for most locations in Virginia is 5.3%. Several areas have an additional regional or local tax as outlined below. In all of Virginia, food for home consumption (e.g. grocery items) and certain essential personal hygiene items are taxed at a reduced rate of 1%.

How do you calculate sales tax in Virginia?

How 2023 Sales taxes are calculated in Virginia. The state general sales tax rate of Virginia is 4.3%. Cities and/or municipalities of Virginia are allowed to collect their own rate that can get up to 1% in city sales tax.

What is tax exempt in Virginia?

Industrial materials sold to make things, or parts of things, that will be sold to someone else are not subject to sales tax. Machinery, tools, fuel, and supplies used to make things out of these industrial materials are also exempt from sales tax.

What is Form ST-9?

Form ST-9 - Virginia Retail Sales and Use Tax Return.

What in Virginia charge a 6% sales tax?

The sales tax rate for most locations in Virginia is 5.3%. Three areas have an additional regional tax as outlined below: Hampton Roads - 6% - Includes: Chesapeake.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute pdffiller online?

Filling out and eSigning va sales tax form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the va st9 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out st 9 form virginia on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your virginia sales tax form st 9 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is VA DoT ST-9 & ST-9A?

VA DoT ST-9 and ST-9A are forms used by the Virginia Department of Taxation to report and remit sales and use tax collected on sales made in the state.

Who is required to file VA DoT ST-9 & ST-9A?

Businesses and individuals who collect sales and use tax in Virginia are required to file VA DoT ST-9 and ST-9A.

How to fill out VA DoT ST-9 & ST-9A?

To fill out VA DoT ST-9 and ST-9A, taxpayers must provide their business identification information, report total sales and tax collected, identify exempt sales and purchases, and calculate the total amount due or refund.

What is the purpose of VA DoT ST-9 & ST-9A?

The purpose of VA DoT ST-9 and ST-9A is to ensure the collection and proper remittance of sales and use tax to the Virginia Department of Taxation.

What information must be reported on VA DoT ST-9 & ST-9A?

The information that must be reported includes the business name, identification number, total sales, total tax collected, exemptions claimed, and any amounts due or refunds requested.

Fill out your VA DoT ST-9 ST-9A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Va st9 Form is not the form you're looking for?Search for another form here.

Keywords relevant to st9 form va

Related to virginia st 9

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.